|

April 8, 2024 — Issue No. 761

Dear Subscriber,

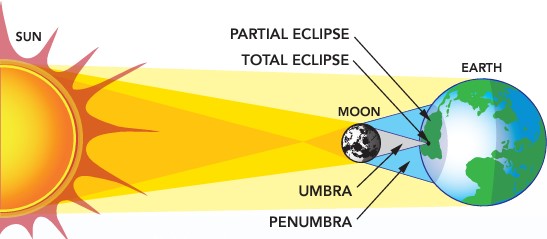

We are back to our regularly scheduled program after Spring Break, just in time to see our local star align with our only moon to generate a total solar eclipse. This event occurs every year and a half somewhere on the planet but lasts less than 10 minutes. While the eclipse lasts mere minutes, the financial alignment between precious metals and the equities levered to them might offer longer-lasting opportunities for investors. We are back to our regularly scheduled program after Spring Break, just in time to see our local star align with our only moon to generate a total solar eclipse. This event occurs every year and a half somewhere on the planet but lasts less than 10 minutes. While the eclipse lasts mere minutes, the financial alignment between precious metals and the equities levered to them might offer longer-lasting opportunities for investors.

In the Weekly Market Digest, market volatility spiked over the past fortnight as FOMC members continued to debate the number and timing of interest rate cuts. Precious and industrial metals and the majority of the equities linked to them thrived in this environment.

The Exploration Insights Portfolio had its most positive week in a long time, led by its most leveraged gold development plays. I reviewed the growth in the projected revenue from a Top Pick cash-flowing royalty company and the drilling progress from a gold project in Guatemala.

In Stock Talk, I made some changes to the portfolio by removing a pair of advanced precious metal explorers to make room for a potential unicorn precious metal play in Victoria and a solid PGM story in Brazil that is trading at its IPO price.

In addition, I reviewed the potential for vertical integration into the US by a REE developer that I will be visiting in a week. A grassroots prospect generator and explorer in Québec generates some PGM-nickel targets with a partner, while a grassroots precious metal explorer in Nevada is funded by its partner to drill in 2024.

To read the rest of today's Exploration Insights click on the link below to log in and gain access to the article:

Read Now

|